More and more positive mentions of home sales are being seen in the media.

More and more positive mentions of home sales are being seen in the media.

NAR projects that sales will have a gradual upturn becoming more pronounced by the end of 2007. FAR reports that statewide sales of existing single-family homes in Florida totaled 12,607 in May, which is more in line with May 2002 activity, prior to the housing boom years, than May 2006 with 19,072 homes – a 34% decrease in the year-to-year comparison.

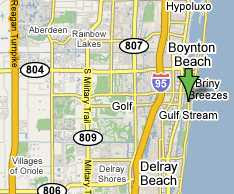

The MSA (Metropolitan Statistical Area) reported that the Boca-West Palm area had 741 homes sold last month compared to 982 a year ago, producing a 25% decrease. Median price was $387,800 whereas in May 2006 it ws $391,000 resulting ina 1% decrease. 613 existing condos changed hands last month, up 11% from the 552 condos sold the previous year. Existing condo medial sales price in May was $217,400; a year ago it was $218,900, for a 1% decrease.